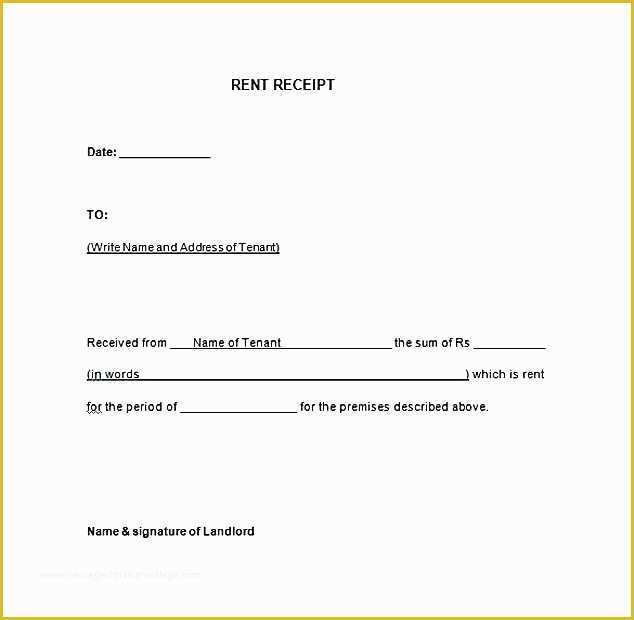

Without proper documentation and receipts, a tenant may have to double pay for previous months’ rent and face unnecessary confrontations with the landlord. In these situations, it is much easier to present the landlord with a receipt that proves payment than it is to challenge the bookkeeper. Additionally, tenants are sometimes faced with having a new property manager claim that a previous manager did not document a rent payment.īookkeeping errors can also be reason enough for a landlord or an apartment manager to claim that the tenant may not have paid rent. This issue comes up more often with management companies that have high employee turnover. By keeping an organized folder with documents related to your tenancy and payment activity, a tenant can better protect themselves from a landlord who may claim that rent was not received on time or is missing. You may also want to print out bank statements detailing rent payment and save them along with other documents related to paying rent. It is generally a good idea to ask for receipts to be dated and signed or stamped by the landlord or the management company. Under the new law, tenants still need to ask for receipts if they pay with methods other than cash, such as check or money order. Previously a landlord was only required to provide receipts if the tenant asked for one.

RCW 15.18.063 of the Washington State Residential Landlord-Tenant Act was changed to require landlords to give tenants a receipt when they pay rent in cash.

0 kommentar(er)

0 kommentar(er)